07.19.18

Investment Program Revenue Compression Running at 27 Percent

by: Janet Cappelletti and Scott Stathis, Stathis Partners, LLC

Executives in the investment services bank and credit union channel often debate about whether the often-theorized revenue compression is real, especially given the fact that there are still plenty of high-commission products available. Based on recently aggregated statistics, that debate now seems to be settled.

Investment programs at financial institutions are generating less revenue for each dollar of investment account assets, according to data collected annually for our monthly industry benchmarking study recently released by Stathis Partners.

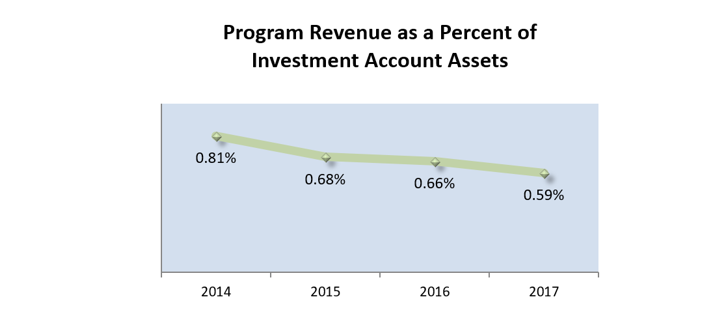

Upon analyzing investment program revenue trends as a percentage of investment account assets over the past four years, the downward trend is very clear and consistent. Revenue as a percentage of investment account assets has decreased by 27 percent from 2014 to the end of 2017. In 2014, revenue generated by investment programs averaged .81 percent of assets under administration. By 2017 that measure fell to .59 percent.

Financial institution channel data shows that this compression is caused by three primary factors: increased fee-based business, increased selection of trail options (as opposed to all up-front commissions) and less of a focus on high-commission products. The catalyst behind these trends is the evolution of fiduciary pressures in the industry.

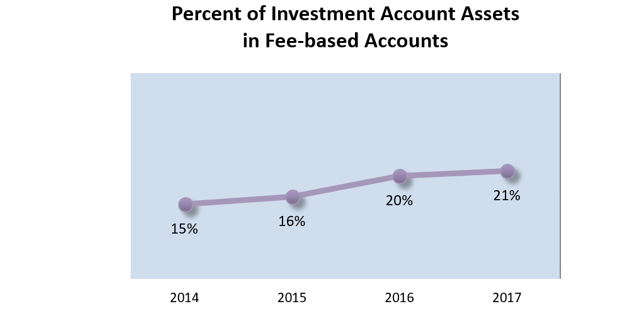

Approximately one-third of new money invested through the bank channel in 2017 went into fee-based advisory accounts, up from one-quarter in 2016. Although these advisory accounts generate significantly less up-front revenue, the lower recurring fees provide a stable long-term revenue stream and more business predictability.

Because of the influx of new money into fee-based accounts, the percent of investment account assets in managed money has grown on average to one-fifth of total investment account assets, as of year-end 2017.

Strategic evolutions in our industry portend that revenue compression pressures will likely continue. Transactions and advice, to a significant degree, have been commoditized largely due to advancements in technology. The combination of robo-advice with remote advisors has reduced the price of advice, and the value of providing transactions has been reduced to next to nothing.

These market pressures and resulting program reengineering efforts will be explored in a soon-to-be-released research whitepaper produced by Stathis Partners and CUSO Financial Services.

Executives in banks and credit unions responsible for running investment and insurance sales operations may be facing the biggest challenge of their careers, but these challenges can be catalysts for increased focus and efficiencies and bring about positive and valuable changes for proactive managers who don’t shy away from competition. Many programs in our channel have had their suspenders stuck on the fence of a transactional history. If the current market challenges get those suspenders unstuck and allow programs to more quickly move forward and away from transactional habits, it will be a very healthy dynamic for our channel.